The Currency of Power

In the vast arena of dirty handed capitalism, there exists a game unlike any other, where the stakes are high, and the players are relentless. Welcome to the world of “other people’s money” – a realm where the pursuit of wealth transcends mere happiness and becomes a testament to the age-old adage of survival of the fittest. Here, individuals and entities engage in a perpetual contest, where the rules are ever-shifting, and the only constant is self-interest.

As we delve into this exploration, we’ll uncover the essence of this game, where legitimacy becomes blurred, and huge sums of paper currency find their way into the hands of bad actors – from state sponsored terrorists to drug dealers to politicians to corrupt officials.

Join us as we journey into the dark corners of wealth accumulation, where insider information, offshore accounts and money laundering schemes reign supreme. We’ll shed light on government kickbacks and tax advantaged arrangements, peeling back the layers of exploitation and deceit that underpin these practices. As we navigate through these murky waters, one truth becomes evident: in the game of other people’s money, the players care more about the game than the players themselves.

Greed Is Good: The Game of Capitalism

This relentless pursuit of success in the game of capitalism is underscored by a culture of cutthroat competition. Individuals and entities alike are willing to go to great lengths to secure their position in the economic hierarchy, often requiring the exploitation of others in the process. The game becomes a battleground where alliances are forged and broken, and where every decision is made with strategic precision. The result is a landscape where the lines between ethical and unethical behavior become increasingly blurred, and where the notion of fair play is overshadowed by the desire for personal gain.

Yet, amidst the chaos and competition of the capitalist game, there are winners and losers. While some may thrive in this cutthroat environment, others are left behind, and in some cases exiled or even killed. As we navigate through this complex world, it becomes clear that the game of capitalism is not just about survival of the fittest, but about the inherent imbalance of power and privilege. In this game, the players may change, but the rules remain the same – it’s all about what’s in it for me.

Laundering Legitimacy: A Dirty Web of Illicit Wealth

Hidden within the intricate maze of capitalism are the shadowy recesses where wealth accumulates through nefarious channels, unchecked by moral constraints. Here, the pursuit of profit transcends ethical conduct, leading to the emergence of nefarious actors who exploit loopholes and manipulate systems for personal gain.

The methods employed by these actors to conceal and utilize their ill-gotten gains are as diverse as they are clandestine. Offshore accounts and shell companies serve as conduits for money laundering, allowing dirty money to flow freely across borders with minimal scrutiny. Meanwhile, the complicity of financial institutions and regulatory bodies further facilitates the proliferation of illicit wealth, turning a blind eye to the systemic corruption that permeates the global financial system.

HSBC Bank has garnered notoriety as a hub for money laundering, with a reputation tarnished by allegations of facilitating illicit financial activities on a global scale.

As we peer into these dark corners of wealth accumulation, the scale of the problem becomes apparent. Billions of dollars change hands in a growing marketplace of dirty money, funding criminal enterprises and fueling corruption on a global scale. The repercussions of these activities extend far beyond the realm of finance, destabilizing economies, eroding trust in institutions, and perpetuating social inequality. In the pursuit of profit, the distinction between right and wrong becomes increasingly blurred, and the moral fabric of society is stretched to its breaking point.

Ubiquitous Exploitation: Government Kickbacks

Embedded within the intricate framework of capitalism are mechanisms of legalized exploitation, where the powerful leverage their influence to manipulate systems for personal gain. One such mechanism is the insidious practice of government kickbacks, where officials, both domestic and foreign, solicit bribes and kickbacks in exchange for favorable treatment or access to lucrative contracts.

How It Works: Foreign Government Kickback Cash Transfer

After tax revenue funds have been transferred to the company that won the government contract and laundered, a meet up is arranged at a remote location, often at night. The biggest risk to these money transfers is the very real possibility that a third party will steal the money mid-transfer. Both the money transferring organization and the receiving government official will hire a security company to make sure there is a smooth transaction. These security and money transfer companies are everywhere, and are usually a shadow component of their larger legitimate corporate organizations.

Spotters and snipers are positioned nearby, and literally have the exchanging parties in their cross hairs at all times. A drone is used to provide a real time situation awareness picture of the funds transfer site, even at night. Multiple vehicles that are the same in terms of make, model and color are used to confuse which vehicle the money was transferred to when all parties drive off in different directions. Funds are usually provided in new or newer USA $100 bills. These illegal transactions are quite commonplace in contacts for defense, energy, transportation and many other industries.

Photography by David Tashji

Similarly, tax havens serve as special vaults for the wealthy elite to shield their assets from scrutiny and evade their fair share of taxes. Through complex corporate structures and legal loopholes, individuals and corporations exploit these jurisdictions to minimize their tax liabilities, depriving governments of much-needed revenue for essential services and social programs. The result is a system where the burden of taxation falls disproportionately on the shoulders of ordinary citizens, while the privileged few enjoy the fruits of their ill-gotten gains with impunity.

As we confront the reality of legalized exploitation, it becomes clear that these practices are not merely aberrations of the system, but integral components of the capitalist game. The collusion between government officials and corporate interests perpetuates a vicious cycle of corruption and inequality, where the rules are rigged in favor of the wealthy elite. In this environment, the pursuit of profit trumps principles of fairness and justice, leaving ordinary citizens to bear the brunt of the consequences. If capitalism is to fulfill its promise of prosperity for all, it must reckon with the systemic injustices that allow legalized exploitation to flourish unchecked.

Cryptocurrency: The Untraceable Path of Illegitimate Fortunes?

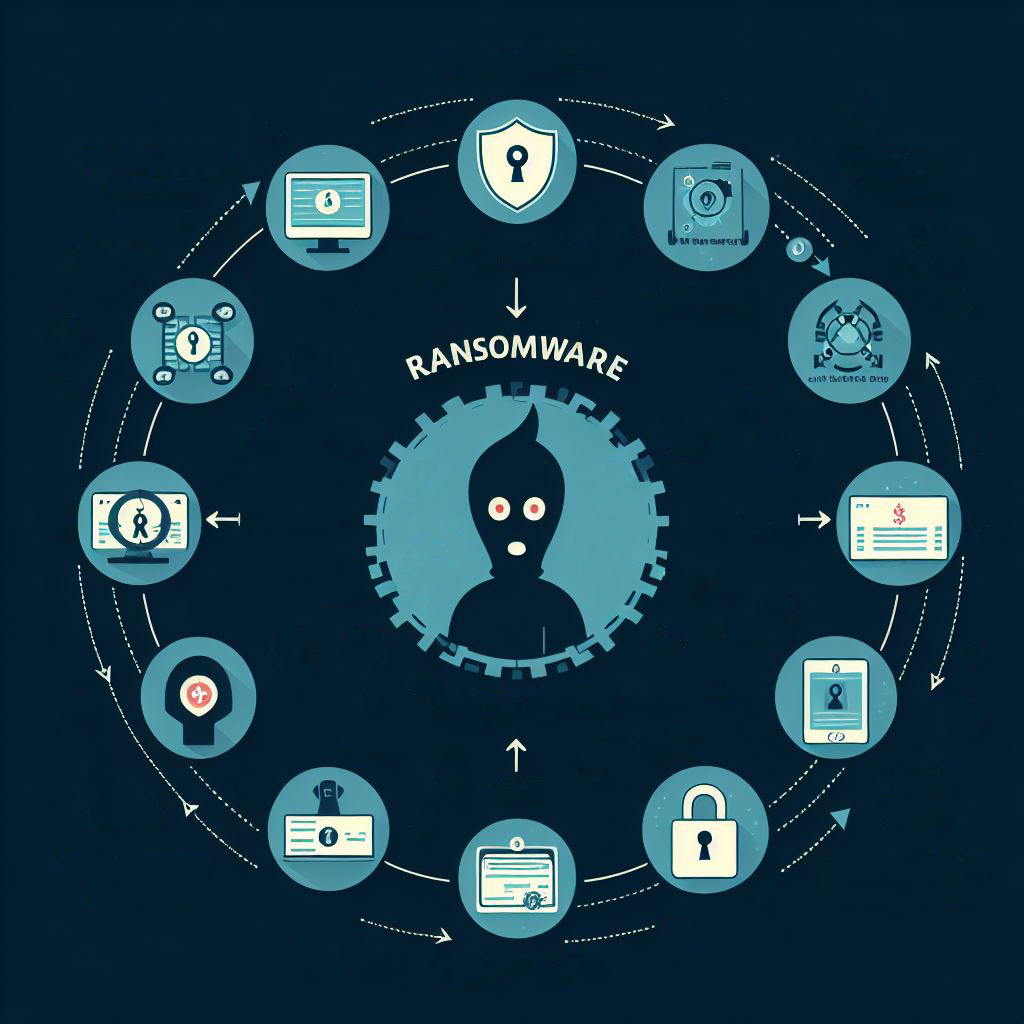

Cryptocurrency has emerged as a double-edged sword in the realm of wealth accumulation from other people’s money, particularly in the context of ransomware attacks. On one hand, the decentralized and pseudonymous nature of cryptocurrencies like Bitcoin has provided a fertile ground for criminal actors to launder ill-gotten gains and evade detection by authorities. Ransomware attacks, where malicious actors encrypt data and demand cryptocurrency payments in exchange for decryption keys, have reached record levels, posing significant challenges for law enforcement agencies worldwide.

“There are only two types of companies that exist.

Those that have been hacked and those that don’t know it yet.”

These attacks not only disrupt the operations of businesses and organizations but also serve as a lucrative source of income for cybercriminals, who exploit the anonymity and ease of transactions offered by cryptocurrencies to extort victims for large sums of money. The accumulation of wealth from ransomware attacks represents a stark example of the dark side of cryptocurrency, where the technology intended to empower individuals and facilitate financial freedom is weaponized for malicious purposes.

2024 is already on track to be the biggest year by revenues for ransomware attacks around the world.

While blockchain technology holds immense potential for innovation and disruption across various industries, its unregulated nature has also made it susceptible to exploitation by bad actors. As governments and regulatory bodies grapple with the challenges posed by ransomware and other forms of cybercrime, finding a balance between innovation and security will be paramount in ensuring the long-term viability of cryptocurrencies as a legitimate financial asset.

Capitalism’s Conundrum: The Fine Line Between Opportunity and Exploitation

In the corridors of the business of government, access to privileged information can be a golden ticket to wealth. Nancy Pelosi, a prominent figure in American politics, has found herself at the center of a controversial phenomenon known as the “Nancy Pelosi Index.” This index represents the collective investment decisions made by Pelosi and her husband based on her unique insights and position within the federal government. Over time, Pelosi’s investment selections have consistently outperformed the market, leading to speculation that she may be leveraging her privileged information for personal gain.

The Pelosi Stock Index has consistently out performed other key financial industry benchmarks.

The success of the Nancy Pelosi Index has sparked intrigue and debate, with some viewing it as a testament to Pelosi’s shrewd financial acumen and others raising concerns about the ethical implications of using privileged information to inform investment decisions. Pelosi’s ability to consistently outperform the market has attracted the attention of investors and analysts alike, with some even using her investment selections as a guide for their own portfolios. This phenomenon highlights the pervasive influence of insider knowledge in shaping financial outcomes and underscores the blurred lines between public service and personal enrichment.

However, the existence of the Nancy Pelosi Index also raises questions about accountability and transparency in government. As a public servant entrusted with representing the interests of the American people, Pelosi’s use of privileged information for personal gain raises ethical concerns and erodes public trust in the integrity of the political system. The phenomenon serves as a stark reminder of the inherent power dynamics at play in the world of finance, where access to information can mean the difference between success and failure.

The Decline of the Dollar: Implications for Other People’s Money

The status of the US dollar as the world’s primary reserve currency has long been a cornerstone of global finance. However, whispers of change are beginning to ripple through the corridors of power, as the dollar’s hegemony faces mounting challenges. With nations increasingly diversifying their reserves and exploring alternative currencies, the once-unquestioned supremacy of the dollar is being called into question, as is the staggering debt.

As the dollar competes with near peer adversaries in todays great power rivalries in a race to technological surprise and enduring decision advantage, the no rules game of other people’s money stands poised for transformation. The shift away from the dollar as the anchor currency could have far-reaching implications, reshaping the dynamics of wealth accumulation and exploitation on a global scale.

Conclusion:

In the intricate web of capitalism, the concept of “other people’s money” is not merely a theoretical abstraction but a stark reality that permeates every facet of our economic system. Through our exploration, we have peeled back the layers of exploitation and deceit that characterize the accumulation of wealth from other people’s money.

From the cutthroat world of finance, where self-interest reigns supreme and the pursuit of profit often eclipses ethical considerations, to the dark corners of wealth accumulation, where illicit activities thrive in the shadows of bureaucracy, the game of capitalism is rife with opportunities for exploitation. Government kickbacks and tax havens serve as normalized mechanisms for the powerful to manipulate systems for personal gain, perpetuating a cycle of corruption and inequality that undermines the very foundations of our society.

“The pursuit of profit at any cost comes at a steep price – one paid not only in monetary terms but in the erosion of trust, integrity, and social hegemony”.

The rise of cryptocurrency has introduced new challenges in the realm of wealth accumulation from other people’s money, with ransomware attacks exploiting the anonymity and decentralization of blockchain technology to extort victims for profit. As we confront these realities, it becomes clear that the pursuit of profit at any cost comes at a steep price – one paid not only in monetary terms but in the erosion of trust, integrity, and social hegemony.

Image Credits & Acknowledgements:

{1} Image Credit: Modeled on the United States’ Federal Bureau of Investigation or FBI, the PGR, or Procuraduría General de la República is the former name of the Attorney General of Mexico’s Office Fiscalia General de la Republica. The PGR commands the Policía Federal Ministerial (PFM), Mexico’s plain clothes criminal investigations force where agents often wear masks to avoid being identified by gang leaders, and they wear uniforms when carrying out raids like in the one pictured. Photography by Undisclosed.

{2} Image Credit: Policía Federal Ministerial (PFM). Large piles of US one hundred dollar bills are accumulated in specially designed temperature and fire proof rooms. Bank notes have been carefully packaged and stacked into hidden concealments like false front walls, book cases and filing cabinets. Photography by Undisclosed.

{3} Image Credit: Dawson, Simon & Wilson, Harry, The HSBC office building in Canary Wharf, London United Kingdom for Bloomberg 2024.

{4} Image Credit: Tashji, David, How It Works: Foreign Government Kickback Cash Transfer, Illustration, March 31, 2024.

{5} Image Credit: Tashji, David, Saddam Hussein planes filled with Iraqi state gold, July 15, 2010.

{6} Image Credit: Tashji, David, “There are only two types of companies that exist. Those that have been hacked . . . and those that don’t know it yet.” Ransomware Illustration March 17, 2024.

{7} Image Credit: Sabin, Sam, Ransomware gangs collected record $1.1 Billion in 2023. Data by Axios, 2024.

{8} Image Credit: Dipasupil, Dia, Rep. Nancy Pelosi’s stock portfolio had a 65% return on investment in 2023. Photo by /Getty Images.

{9} Image Credit: Tashji, David, “The Decline of the Dollar: Implications for Other People’s Money”, Illustration, January 15, 2024.

{10} Image Credit: Tashji, David, “The pursuit of profit at any cost comes at a steep price – one paid not only in monetary terms but in the erosion of trust, integrity, and social hegemony”. March 31, 2024.

Pingback: From Wall Street to the Pentagon | The Role of Finance in Modern Warfare |