In the world of defense contractors, where legacy companies like Lockheed Martin, Boeing, General Dynamics and Raytheon have long dominated, one newcomer has shaken things up: Anduril Industries. Founded in 2017 by Palmer Luckey, the creator of Oculus VR, Anduril is pioneering a revolution in how defense technology is developed and deployed, with a sharp focus on artificial intelligence, unmanned systems, and automation.

Palmer Luckey’s journey from Silicon Valley innovator to defense industry disruptor is nothing short of remarkable. Known primarily for his work in virtual reality, Luckey’s leap into defense technology might have seemed unexpected. However, his technological vision, entrepreneurial drive, and unconventional approach have positioned Anduril as one of the most forward-thinking defense companies in the world.

A New Approach to Defense

From its inception, Anduril positioned itself differently from traditional defense contractors. While older firms tend to focus on decades-long procurement cycles and slow-moving development processes, Anduril embraced a Silicon Valley-style “move fast and break things” mindset. This approach, combined with cutting-edge technologies like AI and autonomous systems, enabled Anduril to rapidly develop products that addressed critical defense needs.

The company’s flagship product, the Lattice AI platform, integrates sensors, cameras, drones, and other systems to create a real-time, autonomous surveillance network. Using artificial intelligence, Lattice identifies threats, analyzes data, and offers actionable insights to operators. This system quickly garnered attention, particularly from U.S. Customs and Border Protection, which deployed Lattice along the U.S.-Mexico border to detect and deter illegal crossings.

Beyond surveillance, Anduril has made strides in developing unmanned aerial vehicles (UAVs) and other autonomous systems. Unlike many defense contractors that prioritize military hardware for traditional warfare, Anduril is focused on the technological future of conflict. Luckey has emphasized that future warfare will be decided by which country can better harness the power of AI and automation— not just in the air but also in space, cyberspace, and even underwater.

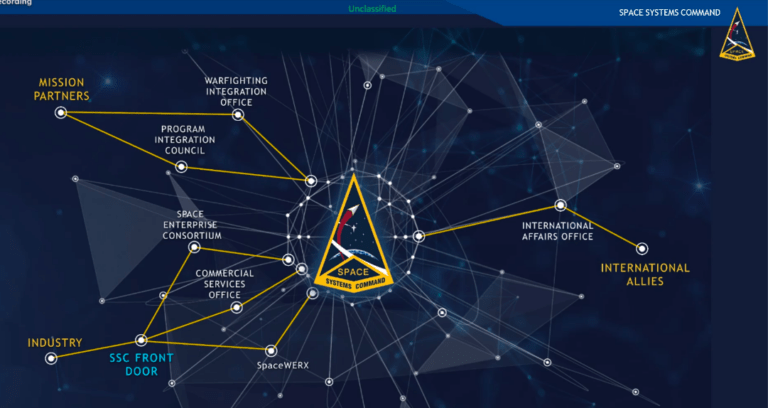

“To succeed, we will need a very different kind of military. This will require us to prioritize networks over platforms. Those networks must be highly dynamic, distributed, re-composable, self-healing, and intelligent”

Credit: Christian Brose – Chief Strategy Officer

Breaking into the Defense Ecosystem

What sets Anduril apart is its ability to secure key contracts and partnerships with the U.S. Department of Defense (DoD), positioning itself as a nimble alternative to older, slower competitors. Luckey’s vision of a technology-first defense contractor has resonated with defense agencies looking for quicker and more innovative solutions to modern problems, especially in areas like border security, counter-terrorism, and military intelligence.

This approach has not been without controversy. Critics argue that Anduril’s rapid ascent raises concerns about oversight and the ethical implications of deploying AI-driven surveillance and autonomous weapons. However, these concerns have done little to slow down the company’s momentum, as the military-industrial complex increasingly leans on AI and automation to handle a growing number of missions.

Anduril’s Leadership in a New Era of Defense Technology

While much of the defense industry has focused on physical assets—ships, tanks, planes—Anduril has embraced a future where software, AI, and data will be the decisive factors in conflict. In Palmer Luckey’s view, the next major leap in defense technology will come from mastering the digital battlefield. As cyberwarfare, AI-driven intelligence, and autonomous drones become the norm, companies like Anduril are set to outpace competitors still rooted in 20th-century warfare models.

Anduril’s meteoric rise is also fueled by its ability to attract top talent from Silicon Valley. Instead of following the traditional path of hiring ex-military personnel to lead development, Anduril has built a team of engineers, software developers, and technologists who think beyond conventional defense technologies. This tech-first approach has allowed the company to push the boundaries of innovation much faster than its competitors.

Ultra-wealthy tech Billionaires like Palmer Lucky, Elon Musk, Yuri Milner and others are influencing global conflicts through their financial power and strategic investments. Delve into the implications of this new dynamic in warfare, examining the interplay between wealth, technology, and statecraft:

Billionaires at War: High Stakes and High Net Worth

The Defense Industry’s New Player

In the span of just a few years, Anduril has gone from a small startup to a key player in the defense industry. By fusing advanced AI with unmanned systems and targeting emerging areas of warfare, Anduril has positioned itself as the future of defense technology. However, the company’s success has also put it on a collision course with the industry’s titans.

The story of Anduril’s rise is one of disruption, ambition, and a relentless focus on innovation. As defense technology moves into an era defined by artificial intelligence, automation, and unmanned systems, Palmer Luckey’s Anduril Industries is leading the charge. But how does Anduril stack up against the established defense contractors it seeks to unseat? In the next chapter, we’ll explore how Anduril’s AI-driven surveillance technologies compare to those of its competitors and what that means for the future of defense.

AI-Driven Surveillance: Anduril vs the Competition

Anduril’s Lattice AI platform has been at the forefront of its rapid rise, offering an autonomous, real-time surveillance system that integrates sensors, cameras, drones, and other assets. Lattice uses artificial intelligence to detect, identify, and track potential threats, providing operators with a continuous, actionable feed of data. This capability has been particularly appealing to U.S. government agencies for border security, and it has drawn interest for potential military applications. The system’s strength lies in its ability to process vast amounts of data quickly and autonomously, giving Anduril a unique position in the AI-driven surveillance market.

However, Anduril faces stiff competition from tech giants like, IBM, Booz Allen Hamilton, Palantir and Microsoft, all of which have heavily invested in AI-powered surveillance and intelligence solutions. Palantir’s Gotham platform, for instance, has long been used by defense and intelligence agencies to process complex data sets, offering deep analytical capabilities in real time. Microsoft, through its Azure Government Cloud, has integrated AI into military surveillance, allowing agencies to access powerful machine learning tools and secure data sharing. And IBM with its Defense Simulation Analytical Service (DSAS) that is powered by AI & Red Hat OpenShift, a data fabric for CIA and Air Force Intelligence officers. While these competitors are more entrenched in traditional government contracts, Anduril’s focus on delivering a fully autonomous, software-first system is seen as more agile and adaptable to future defense needs.

For a comprehensive deep dive into the new era of AI powered surveillance, please see:

Nowhere to Hide: The AI Revolution in Surveillance & Targeting Sensors

Anduril’s advantage lies in the speed and efficiency of its system. Traditional contractors often rely on slower, less flexible surveillance solutions that require human operators for much of the decision-making process. By automating threat detection and providing real-time analysis without human input, Anduril is positioning itself as the future of AI surveillance. However, competitors like Palantir, Microsoft and many others still hold significant leverage due to their broader industry experience, established government relationships, and the scalability of their platforms. The real test for Anduril will be whether it can continue to innovate fast enough to stay ahead in this crowded and evolving space.

Unmanned Systems: The Future of Warfare

Anduril Industries has made significant strides in the development of unmanned systems, positioning itself as a key player in the future of autonomous warfare. Its Ghost drones are designed to operate autonomously in contested environments, providing real-time intelligence, surveillance, and reconnaissance (ISR) without the need for human control. These drones are capable of long-range missions and can be deployed rapidly in areas where traditional manned systems might struggle. By leveraging advanced AI to enhance autonomy, Anduril’s unmanned systems are paving the way for the future of combat operations, where machines can handle complex tasks without direct human oversight.

When compared to competitors like General Atomics, known for its MQ-9 Reaper drones, and Lockheed Martin, which is pioneering unmanned helicopters and ground systems, Anduril stands out for its focus on versatility and AI integration. General Atomics’ MQ-9 Reapers, while powerful, still rely heavily on human pilots and controllers for mission execution, while Anduril’s Ghost drones are designed for greater autonomy and decision-making in real time. Lockheed Martin, with its experience in both air and ground unmanned systems, has an edge in terms of platform variety, but Anduril’s commitment to pushing the boundaries of AI-driven autonomy gives it a competitive edge in developing smarter, more efficient drones for modern warfare.

Anduril’s key advantage is its ability to deliver integrated solutions where unmanned systems, AI, and surveillance platforms work seamlessly together. Unlike its larger competitors, who often focus on standalone products, Anduril emphasizes creating a cohesive network where drones, sensors, and software combine to deliver comprehensive situational awareness. This networked approach is increasingly important in an era where battles are decided by information superiority. However, with companies like General Atomics and Lockheed Martin continuing to innovate in the unmanned space, the competition remains fierce, and Anduril will need to continuously evolve its technology to stay ahead in the race for the future of unmanned warfare.

Fury and Barracuda: The New Arsenal of Autonomous Airpower

Anduril’s push into the uncrewed combat air vehicle (UCAV) space reached a new level with the introduction of Fury, designated the YFQ‑44A by the U.S. Air Force. Originally developed by Blue Force Technologies and later acquired by Anduril in 2023, Fury is a high-performance, modular jet designed to operate autonomously in contested airspace. Capable of sustained supersonic speeds, high-G maneuverability, and multi-mission payload adaptability, Fury represents a next-generation alternative to expensive, manned fighters. It is a core platform in the Air Force’s Collaborative Combat Aircraft (CCA) initiative and has become central to the Pentagon’s broader autonomy roadmap.

Meanwhile, Anduril has also quietly unveiled a new line of Barracuda cruise missiles, designed for low-observable delivery and precision strike at long ranges. Built with modular warheads and integrated with Anduril’s Lattice software, Barracuda units are being positioned as a cost-effective, mass-producible solution for saturation attacks and strategic deterrence. Together with Fury, Barracuda reflects Anduril’s maturing ambition—not just to build surveillance drones or C4ISR nodes, but to own the entire kill chain in autonomous warfare.

The Defense Innovation Unit (DIU) and U.S. Air Force have both heavily invested in these platforms, not only for their technical capabilities but also for what they represent: the ability to field AI-native weapons systems that are manufactured at speed, updated via software, and deployed in swarms. Anduril’s model contrasts sharply with legacy aerospace contractors, offering an alternative timeline—where weapons are not just procured, but rapidly evolved. In this context, Fury and Barracuda are not simply new products; they are harbingers of a doctrinal shift toward distributed lethality and edge-enabled command and control.

Arsenal-1: Anduril’s $1 Billion Bet on Industrial-Scale Defense Tech

In January 2025, Anduril Industries announced Arsenal‑1, a massive $1 billion production and R&D facility in Ohio, signaling its commitment to build hardware as agilely as it writes code. Branded as a “software-integrated weapons factory,” Arsenal‑1 will serve as the central node in a national network of manufacturing hubs capable of turning digital twin designs into physical platforms within weeks. This move marks a significant departure from the historical bottlenecks of defense production, where even simple systems can take years to deliver.

Unlike traditional primes, Anduril is betting that vertically integrated manufacturing—augmented by AI-driven design, robotics, and agile iteration—can unlock economies of scale in defense systems. Arsenal‑1 is not just about volume; it’s about velocity. According to company executives, the facility will mass-produce systems like Fury, Altius, and Ghost Shark, while also supporting rapid prototyping of classified technologies under government contract. It’s the defense industrial base’s equivalent of a Tesla Gigafactory, designed for defense autonomy and resilience in a time of contested logistics.

The selection of Ohio reflects Anduril’s strategy to revitalize American defense manufacturing in the heartland, pulling skilled labor from aerospace and automotive sectors while insulating its operations from coastal geopolitical and supply chain risks. Moreover, Arsenal‑1 positions Anduril as a production peer—not just a startup disruptor—to Lockheed, Boeing, and Raytheon. In this sense, the factory is as much a political statement as it is a technological one: America can rebuild its military edge not by going bigger, but by building smarter.

Taking Over IVAS: Anduril’s Strategic Leap into Soldier Wearables

In February 2025, Anduril made headlines by assuming control of Microsoft’s Integrated Visual Augmentation System (IVAS) program, a long-troubled Army initiative to equip warfighters with augmented-reality-enabled headsets. Following years of setbacks—including field failures, cost overruns, and soldier dissatisfaction—Microsoft reportedly reached an agreement to transition the program to Anduril, who will now lead development, fielding, and lifecycle integration of IVAS 2.0. This move cements Anduril’s growing role in the human-machine interface domain, expanding its footprint beyond sensors and drones into dismounted soldier technology.

The IVAS program, originally envisioned as a “mixed reality warfighter environment,” combines thermal imaging, night vision, navigation, targeting, and biometric sensing into a single headset linked to the broader battlefield network. Anduril plans to integrate IVAS with its Lattice OS, providing seamless interoperability between individual warfighters and autonomous systems like Altius, Ghost, and Fury. This would turn every infantry unit into a real-time node in the Anduril battlespace ecosystem—connected, context-aware, and empowered by AI-processed data feeds.

By taking over IVAS, Anduril is not merely fixing a broken program—it’s redefining how warfighters experience and interact with the digital battlefield. This plays directly into Pentagon ambitions for JADC2 (Joint All-Domain Command and Control), in which human-machine teaming becomes the default, not the exception. With IVAS under its control, Anduril now has a unique opportunity: to shape not just the future of autonomy in war, but also the future of the human warrior within it.

Undersea Warfare: Anduril’s Naval Expansion

While Anduril Industries is best known for its AI-driven surveillance and aerial drones, the company is also making bold moves into undersea warfare, an area of increasing strategic importance. Autonomous underwater vehicles (AUVs) are quickly becoming crucial assets in naval operations, capable of performing tasks like surveillance, mine detection, and anti-submarine warfare. Anduril’s expansion into this domain signals a recognition of the growing role that undersea systems will play in future conflicts, especially as nations compete to control critical maritime chokepoints and monitor vast stretches of ocean.

Anduril Expands AUV Manufacturing Facilities at Quonset Point Rhode Island

“Anduril joins an esteemed list of the nation’s leading defense contractors with operations in Rhode Island, like General Dynamics Electric Boat, Raytheon, and Textron, among others. Their addition further demonstrates Quonset as a hub of good-paying, quality jobs for Rhode Islanders that will help our state in raising incomes for all.”

Credit: Rhode Island Governor Dan McKee

In this space, Anduril is competing with well-established defense giants like Boeing, which developed the Echo Voyager, a long-endurance AUV designed for deep-water missions. Boeing’s Echo Voyager is capable of operating autonomously for months, collecting intelligence and performing reconnaissance missions without human intervention. Similarly, Lockheed Martin has invested heavily in undersea systems, producing cutting-edge technologies like the Orca AUV, which combines stealth, endurance, and advanced sensors to conduct critical naval operations. These competitors have deep experience and significant resources, but Anduril brings a software-first, AI-driven approach that could offer faster adaptability and more intelligent decision-making in underwater missions.

Anduril’s primary advantage in the undersea domain is its ability to integrate AI across multiple platforms, creating a unified system that can adapt and respond in real time. The company’s expertise in autonomous systems gives it a unique edge in crafting AUVs that operate with minimal human input, and its commitment to rapid development cycles could allow it to introduce innovations faster than larger, slower-moving competitors. However, Anduril is still in the early stages of breaking into this market, and it will need to prove that its AI-driven solutions can match or surpass the endurance, reliability, and stealth capabilities of its rivals. In the high-stakes arena of undersea warfare, where stealth and persistence are paramount, Anduril faces an uphill battle but is well-positioned to disrupt the status quo with its technological approach.

Beneath the Waves: Copperhead and Ghost Shark Shape the Future of Undersea Warfare

Anduril’s foray into undersea warfare has rapidly evolved from a novel experiment to a strategic cornerstone in both U.S. and allied maritime defense strategies. At the center of this transformation is the Copperhead family of Uncrewed Underwater Vehicles (UUVs)—a modular, AI-native fleet designed for a broad spectrum of missions ranging from anti-submarine warfare and seabed surveillance to mine countermeasures. Copperhead’s open architecture allows rapid payload swapping, edge-based autonomy, and real-time data transmission back to command nodes, transforming how the Navy thinks about persistence and deterrence beneath the ocean’s surface.

Complementing Copperhead is Anduril’s participation in Australia’s Ghost Shark program, a trilateral effort with the Royal Australian Navy and the Defense Science and Technology Group (DSTG). Ghost Shark is a large-displacement Autonomous Underwater Vehicle (AUV), custom-built for long-range, stealthy operations in the Indo-Pacific theater. As of mid-2025, satellite production lines for Ghost Shark are already delivering units to Australia, marking a major leap in sovereign defense capability for a key U.S. ally. The platform’s strategic intent is clear: outpace Chinese undersea activity through scalable, smart, and hard-to-detect autonomous platforms.

What makes both Copperhead and Ghost Shark unique is how they shift undersea warfare from episodic and manned operations to persistent, autonomous networks. With onboard AI trained to recognize novel objects, acoustic anomalies, and mission-relevant threats, these systems are not just force multipliers—they are force shapers. Anduril’s ability to iterate hardware and software simultaneously, while integrating multi-domain data fusion, gives the U.S. and its allies a new underwater playbook, one that operates 24/7 in contested maritime environments where legacy platforms fall short.

Edge vs. Cloud: Lattice and the Tactical AI Revolution

In the traditional model of defense computing, data flowed like a bureaucracy—slow, centralized, and fragile. Sensor inputs would be transmitted from the edge of the battlefield to distant cloud infrastructure or operations centers, where analysis could take minutes or hours, and only then would decisions make their way back to the warfighter. But Anduril’s Lattice OS flips that paradigm. Designed to operate in degraded, GPS-denied, or communication-contested environments, Lattice processes data at the tactical edge, right where it’s collected. Think of it as AWS meets a forward operating base—with AI onboard, ready to kill latency before it kills a mission.

The system functions more like a battlefield nervous system than a database: drones, sensors, loitering munitions, and even human operators all feed into a shared compute layer that can autonomously fuse, filter, and act on information in milliseconds. This decentralization allows warfighters to maintain decision superiority even when disconnected from central command. According to multiple Defense Department use cases, Lattice has already enabled sensor-to-shooter execution cycles faster than any cloud-reliant architecture. In a future of drone swarms, hypersonics, and AI adversaries, the cloud just can’t keep up.

Recent studies on IoT-enabled combat systems echo this shift—showing that edge-computing architectures not only improve resilience and survivability but are essential for AI decision agents that must operate without human-in-the-loop oversight. What Anduril has built isn’t just a C2 tool; it’s a warfighting substrate. As the Pentagon moves toward JADC2 and ABMS, Lattice is quickly becoming the connective layer—autonomously learning, scaling across domains, and rewriting the tempo of battle. In the end, cloud is for storage. Edge is for survival.

Space-Based Weapon Systems: A New Frontier

As the space domain becomes increasingly militarized, Anduril Industries announced plans and strategic partnerships for creating space-based defense systems, viewing outer space as the next critical frontier for national security. Although much of Anduril’s space-related projects are still under wraps, the company is positioning itself to develop advanced satellite technologies and space-based surveillance platforms capable of monitoring global hotspots from orbit. Space will play a crucial role in future conflicts, with satellites providing communication, navigation, and intelligence capabilities vital for military operations on Earth. For Anduril, this is an opportunity to apply its expertise in AI and autonomous systems to an entirely new battlefield.

In this area, Anduril faces fierce competition from established space players like SpaceX, Raytheon, and Northrop Grumman, all of which have invested heavily in space-based military systems. SpaceX, for example, has a major foothold in the launch and satellite deployment sectors with its reusable rockets and Starlink satellite constellation, which could be leveraged for defense communication. Raytheon and Northrop Grumman are veterans in satellite defense and space-based missile warning systems, making them dominant players in the space weaponization race. These companies have both the infrastructure and the expertise to build advanced space systems, presenting a significant challenge for Anduril to compete with.

However, Anduril’s advantage lies in its ability to develop autonomous and AI-driven space technologies that could change the nature of space warfare. While legacy companies focus on traditional satellite capabilities, Anduril has the potential to create smarter, more agile systems that can operate autonomously, identifying threats and responding to them in real time. If Anduril can successfully apply its AI-first approach to space, it could disrupt the field by introducing more intelligent and responsive systems. Nevertheless, the space-based weapons market is capital-intensive and highly competitive, and it remains to be seen whether Anduril’s innovations can match the scale and sophistication of its rivals’ established programs.

Financing & Production Scalability: Warfighting at Venture Speed

Anduril’s financial trajectory reads less like a traditional defense firm and more like a Silicon Valley moonshot—because it is. Since its founding in 2017, Anduril has raised over $2 billion in venture capital, with its most recent $1.5 billion Series E round (announced in December 2022) pushing the company’s valuation to nearly $9 billion. That kind of funding firepower places it in rare territory: a defense unicorn capable of dictating its own roadmap, without waiting on traditional contract cycles or government bailouts. Its backers aren’t beltway incumbents—they’re the same investors who built Amazon, Palantir, and SpaceX. The goal isn’t just to profit off war; it’s to reinvent the business model of warfighting.

That reinvention is most evident in how Anduril scales. While legacy primes like Lockheed Martin or Boeing need years and billions to ramp up production—often tied to single-award programs—Anduril is building its own facilities (like Arsenal‑1 in Ohio) to iterate, test, and deploy at a fraction of the cost and time. Its model borrows more from Tesla than Raytheon: vertical integration, software-first development, and manufacturing that’s designed to flex with global demand. In a future of contested logistics and time-sensitive conflict, speed and modularity aren’t luxuries—they’re prerequisites for relevance.

What this means for the Pentagon is profound. It offers an alternative to the brittle and backlog-prone industrial base that has struggled to keep up with 21st-century threats. It also introduces a new calculus to acquisition: buy into a company that’s self-capitalized, already building, and aligned with commercial velocity. If Boeing is the Pentagon’s past, Anduril is its plausible future—a tech-driven arsenal where venture capital replaces cost-plus contracts, and readiness isn’t something you procure, it’s something you prototype, ship, and update over the air.

Partnerships and Future Prospects: Shaping Defense for the Next Decade

Anduril Industries has quickly established itself as a force to be reckoned with, not just through its cutting-edge technology but also by securing critical partnerships with government agencies and defense organizations. However, Anduril faces stiff competition from established giants like Lockheed Martin, Boeing, and Raytheon, whose long-standing relationships with the military and deep-rooted infrastructure give them a competitive edge in securing long-term contracts. These companies often benefit from their long histories of delivering large, complex defense programs. Despite this, Anduril’s agility and ability to rapidly innovate have given it a competitive advantage in securing contracts for more agile, tech-centric projects, particularly those involving AI, automation, and unmanned systems. These faster, more flexible capabilities align with modern military needs, where speed and adaptability are crucial.

Looking ahead, Anduril’s future prospects depend on its ability to maintain innovation and scale while competing against traditional contractors. As warfare increasingly relies on autonomous systems, space-based assets, and AI-driven decision-making, Anduril is well-positioned to meet the needs of the future military. However, it will need to continue evolving, expand its partnerships, and potentially collaborate with larger industry players to take on even more complex and capital-intensive projects. If Anduril can continue leveraging its technological edge while scaling its operations globally, it could reshape the defense industry and influence the future of warfare.

Top Takeaways

Anduril’s absorption of the IVAS soldier-AR program from Microsoft reflects its expanding footprint in wearable AI, giving the company a role not just in machines, but in the digital augmentation of the modern warfighter.

Anduril has redefined defense innovation by fusing venture capital speed with battlefield relevance—delivering autonomous weapons, sensors, and software platforms that iterate faster than traditional primes can procure.

Fury and Barracuda mark Anduril’s entry into lethal autonomy, providing the Air Force with AI-native uncrewed fighters and cruise missiles capable of real-time combat decision-making without human pilots.

Undersea dominance is accelerating, as Copperhead and Ghost Shark bring AI-enabled persistent surveillance and strike capabilities to maritime operations, backed by strategic partnerships with allies like Australia.

The Lattice operating system is quietly becoming the digital backbone of JADC2, enabling autonomous sensor-to-shooter loops, edge-based analytics, and real-time battlefield orchestration across all domains.

With Arsenal-1, Anduril is building the world’s first software-integrated weapons factory, scaling production of autonomous systems at speeds unmatched by legacy contractors and signaling a shift in industrial-age warfighting logistics.

Conclusion

Anduril Industries has rapidly emerged as a major disruptor in the defense sector, thanks to its innovative use of artificial intelligence, autonomous systems, and agile development processes. Under the leadership of Palmer Luckey, the company has challenged legacy defense contractors by delivering faster, smarter solutions in areas like AI-driven surveillance, unmanned systems, undersea warfare, and even space-based defense technologies. Anduril’s ability to integrate its technologies across multiple domains gives it a unique advantage, positioning it as a key player in shaping the future of warfare. However, it faces significant challenges from established competitors with deeper resources and decades of government relationships.

Moving forward, Anduril’s success will depend on its ability to scale, maintain innovation, and secure new partnerships in an increasingly competitive environment. The defense landscape is evolving rapidly, with AI, automation, and space technologies at the forefront. As these trends accelerate, Anduril’s vision of a tech-first, AI-driven defense contractor offers a glimpse into what the fight in 2025-2030 could look like, and how to be best positioned to both win on wall street, and deliver the right war winning capability, when and where needed.

NOTICE: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means—electronic, mechanical, photocopying, recording, scanning, or otherwise—without the prior written permission of the author, except in the case of brief quotations embodied in critical articles, reviews, or academic work, or as otherwise permitted by applicable copyright law.

"Anduril's Edge" and all associated content, including but not limited to the report title, cover design, internal design, maps, engineering drawings, infographics and chapter structure are the intellectual property of the author. Unauthorized use, adaptation, translation, or distribution of this work, in whole or in part, is strictly prohibited.

This report is a work of non-fiction based on publicly available information, expert interviews, and independent analysis. While every effort has been made to provide accurate and up-to-date information, the author makes no warranties, express or implied, regarding completeness or fitness for a particular purpose. The views expressed are those of the author and do not necessarily represent the views of any employer, client, or affiliated organization.

All company names, product names, and trademarks mentioned in this report are the property of their respective owners and are used for identification purposes only. No endorsement by, or affiliation with, any third party is implied.

About PWK International Advisers

PWK International provides national security consulting and advisory services to clients including Hedge Funds, Financial Analysts, Investment Bankers, Entrepreneurs, Law Firms, Non-profits, Private Corporations, Technology Startups, Foreign Governments, Embassies & Defense Attaché’s, Humanitarian Aid organizations and more.

Services include telephone consultations, analytics & requirements, technology architectures, acquisition strategies, best practice blue prints and roadmaps, expert witness support, and more.

From cognitive partnerships, cyber security, data visualization and mission systems engineering, we bring insights from our direct experience with the U.S. Government and recommend bold plans that take calculated risks to deliver winning strategies in the national security and intelligence sector. PWK International – Your Mission, Assured.

Pingback: Venture Backed Arsenal |