How AI, Sanctions, and Market Manipulation Are Becoming the Future of Conflict

In the modern era, wars are no longer fought solely on battlefields. Instead, economic measures have emerged as the primary weapons of great powers, reshaping global influence and national security strategies. Financial warfare—ranging from AI-driven market manipulation to sanctions and digital currencies—is now a critical component of geopolitical competition.

Nations, corporations, and even rogue actors are increasingly leveraging economic tools to gain strategic advantages without firing a single shot.

Wall Street is no longer just a hub for financial transactions—it is now a frontline in the battle for global dominance. The increasing use of economic warfare has placed traders, hedge funds, and multinational corporations at the center of international conflicts.

Understanding how these mechanisms work is no longer optional for financial professionals—it is essential for survival in a rapidly evolving landscape.

This report explores the six key dimensions of financial warfare, from AI-powered sanctions and high-frequency trading manipulation to the rise of digital currencies as geopolitical weapons.

Each section examines how economic power is being weaponized and what it means for investors, policymakers, and institutions navigating this volatile environment. The silent war for financial supremacy is already underway. Explore the war where no shots are fired.

The Financial Cold War: How AI and Sanctions Are Redrawing Global Power

Economic sanctions have long been a tool for nations to assert dominance without resorting to military conflict. However, in today’s digital economy, sanctions are no longer blunt instruments—they have become precise, AI-driven tools capable of crippling entire economies in a matter of hours. The United States, European Union, and other global powers are leveraging AI to enforce and expand these measures with unprecedented efficiency.

China and Russia, in response, have sought to build alternative financial infrastructures to bypass Western dominance. The Belt and Road Initiative, alongside China’s push for a yuan-based trade system, is a clear move toward reducing reliance on the U.S. dollar. Meanwhile, Russia has been increasing its use of cryptocurrencies and alternative payment systems to evade economic restrictions. These shifts signal the emergence of a multipolar financial world order.

AI is also transforming how sanctions are enforced. Predictive analytics allow governments to detect sanction violations before they occur, freezing assets and blocking transactions preemptively. While this enhances effectiveness, it also raises concerns about false positives and the potential for economic suppression based on algorithmic decision-making.

The rise of economic blocs such as BRICS (Brazil, Russia, India, China, South Africa) is further complicating the global financial landscape. These nations are actively working to reduce their dependence on Western financial systems, seeking to establish parallel trade networks and alternative reserve currencies. As this Financial Cold War escalates, investors must prepare for increasing fragmentation and volatility in global markets.

Understanding Cross-Border Payments and Financial Messaging Systems

Over the past few decades, global trade, investment, and financial markets have expanded, leading to a significant rise in cross-border payments. Unlike domestic transactions, processing international payments is more complex and requires specialized systems to ensure smooth transactions. Financial messaging systems play a crucial role in facilitating international payments for trade, investment, and remittances. These systems allow financial institutions to send and receive secure messages that confirm payment details, such as transaction type, amount, and the identities of both the sender and recipient. Beyond transaction processing, financial messages are also used by financial institutions and regulators to enforce compliance with anti-money laundering (AML) laws, counter-terrorist financing regulations, and know-your-customer (KYC) requirements.

Standardization of Financial Messages

Financial messages follow standardized codes that provide essential instructions for transactions. The International Organization for Standardization (ISO)—a Switzerland-based body founded in 1947—develops and maintains these standards. National standards organizations, including the American National Standards Institute (ANSI) in the United States, contribute to ISO’s work. Many banks and payment systems worldwide rely on ISO standards to ensure seamless financial communication.

SWIFT and Alternative Messaging Systems

Most financial institutions use the Society for Worldwide Interbank Financial Telecommunication (SWIFT) network to exchange financial messages for cross-border payments. However, some national payment systems operate their own messaging networks instead of using SWIFT.

For instance, the Fedwire Funds Service—a real-time gross settlement system operated by the U.S. Federal Reserve—transmits financial messages and settles transactions between banks holding accounts at the Federal Reserve. Fedwire exclusively processes transactions in U.S. dollars, primarily for large-scale payments. While Fedwire serves only U.S. financial institutions, international transactions involving U.S. dollars may require both Fedwire and SWIFT messages at different stages of the payment process.

Cybersecurity Risks in SWIFT

SWIFT has faced significant cybersecurity challenges due to vulnerabilities exploited by hackers targeting financial institutions using its network. One of the most notable incidents occurred in February 2016, when suspected North Korean hackers used compromised SWIFT credentials from Bangladesh central bank employees to send fraudulent transfer requests totaling nearly $1 billion from the bank’s account at the Federal Reserve Bank of New York. While most of the transactions were blocked, approximately $81 million was successfully transferred to accounts at Rizal Commercial Banking Corporation in the Philippines. A Sri Lankan bank employee flagged a separate $20 million transfer, preventing further losses. SWIFT denied responsibility, asserting that individual banks are responsible for securing their systems.

In another case, Vietnam’s Tien Phong Bank revealed in 2016 that it had thwarted a similar attack the previous year, in which hackers attempted to use fraudulent SWIFT messages to transfer over $1 million. While SWIFT’s central network has never been directly compromised, hackers have repeatedly gained access to valid SWIFT credentials at financial institutions, raising concerns about potential misuse to bypass international sanctions and facilitate fraud.

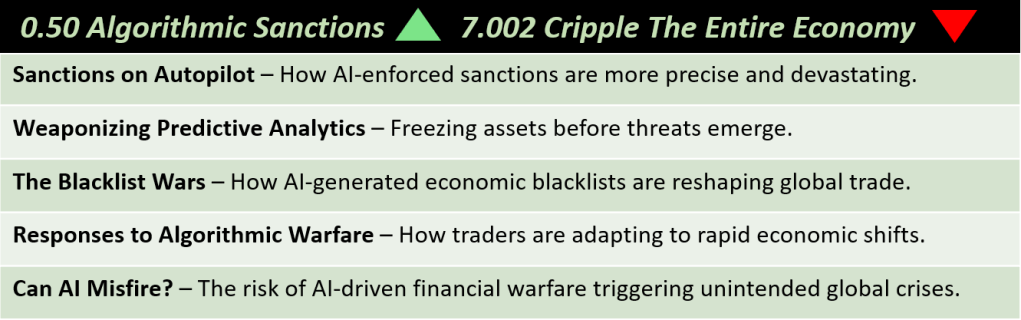

Algorithmic Sanctions: How AI Can Cripple an Entire Economy in Seconds

The future of sanctions enforcement is no longer in human hands. AI-driven systems are revolutionizing the way nations implement and monitor economic restrictions. By scanning vast amounts of financial data, AI can identify illicit transactions, flag suspicious actors, and enforce sanctions with near-instantaneous speed. This level of automation means that economic warfare is becoming more precise—and potentially more dangerous.

One of the most concerning developments is the rise of predictive sanctions. AI systems can analyze historical trends, geopolitical events, and financial movements to anticipate sanction violations before they occur. This allows governments to proactively freeze assets, disrupt trade routes, and isolate adversaries without direct confrontation. However, this preemptive approach risks severe economic fallout if mistakes are made.

The use of AI in financial warfare is not limited to state actors. Rogue groups and cybercriminal organizations are also harnessing machine learning algorithms to evade sanctions. By leveraging decentralized finance (DeFi) platforms and blockchain technology, illicit networks can move funds across borders undetected. This creates a cat-and-mouse game where AI is used both for enforcement and evasion.

As AI-driven financial warfare becomes more sophisticated, the risk of unintended economic consequences grows. A miscalculated AI-generated sanction could freeze assets of legitimate businesses, disrupt global supply chains, or even trigger market crashes. The need for oversight and accountability in AI-powered sanctions is now more critical than ever.

The Digital Dollar Wars: Will the U.S. Lose Its Financial Empire?

The dominance of the U.S. dollar as the world’s reserve currency has long been a cornerstone of American geopolitical power. However, this dominance is now under threat as nations explore alternative financial systems. The rise of central bank digital currencies (CBDCs) and decentralized finance is fundamentally reshaping the global economic order.

China’s digital yuan is at the forefront of this challenge. By developing a state-controlled digital currency, China aims to reduce dependence on the U.S. dollar in international trade. Several countries involved in China’s Belt and Road Initiative have already begun adopting the digital yuan for cross-border transactions, signaling a potential shift in global financial hegemony.

Decentralized finance (DeFi) platforms and cryptocurrencies are further complicating the traditional monetary system. Bitcoin, Ethereum, and other blockchain-based currencies provide a means of conducting transactions outside the reach of central banks and regulatory authorities. This creates both opportunities and risks—while some see DeFi as a tool for financial freedom, others view it as a mechanism for economic destabilization.

As these digital financial networks expand, the U.S. faces a critical question: should it launch its own digital dollar? The Federal Reserve has been researching a potential CBDC, but concerns over privacy, regulation, and economic impact have delayed its implementation. If the U.S. does not act soon, it risks losing financial control to nations that have already embraced digital currencies.

The Dark Side of High-Frequency Trading: Could Algorithmic Traders Spark a Global Crisis?

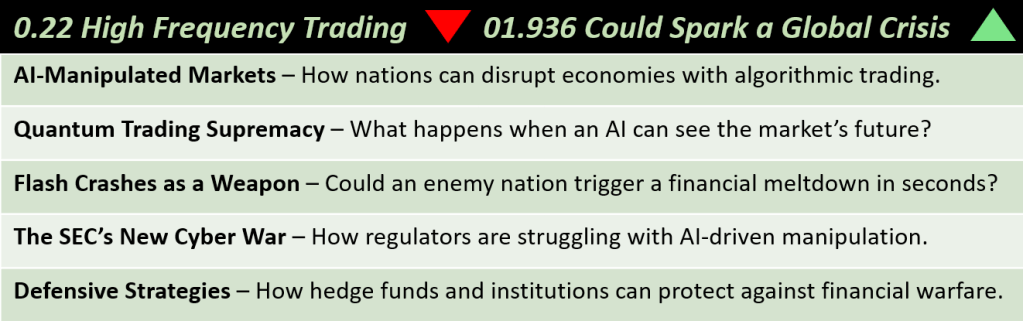

High-frequency trading (HFT) has revolutionized financial markets, allowing trades to be executed in microseconds. However, the very speed that makes HFT so effective also makes it a powerful tool for financial warfare. AI-powered trading algorithms can be weaponized to manipulate markets, destabilize economies, and even trigger financial crises.

State actors and rogue financial firms are already exploring ways to use HFT as a tool for economic disruption. By executing a series of rapid trades, an entity could create artificial volatility, drive down stock prices, or induce panic selling in targeted markets. This level of precision makes financial warfare more sophisticated than ever before.

The rise of quantum computing could further escalate this threat. If a nation develops quantum trading capabilities before its rivals, it could predict market movements with near-perfect accuracy. This would provide an unprecedented advantage, allowing for economic dominance through superior financial intelligence.

Regulators are struggling to keep pace with these advancements. The Securities and Exchange Commission (SEC) and other financial watchdogs are racing to develop AI-driven monitoring systems to detect manipulation. However, as AI evolves, so too do the tactics of those seeking to exploit it. The next financial crisis may not be caused by a housing bubble or a debt default—but by a war waged in milliseconds through algorithmic warfare.

Cyberbanking Wars: Could Your Money Be Held Hostage?

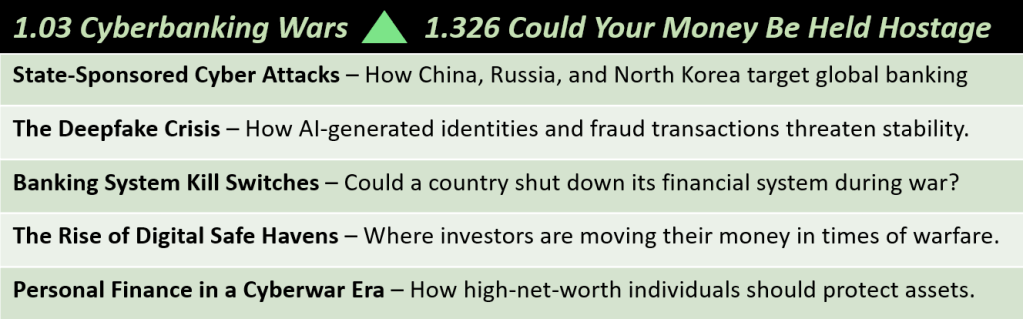

The financial world is facing an increasingly insidious threat: state-sponsored cyberattacks aimed at destabilizing global banking networks. Nations like China, Russia, and North Korea have developed sophisticated cyber capabilities to target financial institutions, often bypassing conventional military conflict. High-profile attacks, such as North Korea’s hacking of the SWIFT network and ransomware assaults on critical payment infrastructures, highlight the fragility of the financial system. These actions can disrupt international trade, freeze accounts, and erode trust in traditional banking systems, leaving businesses and individuals scrambling to recover.

Adding to the chaos is the emergence of “deepfake banking crises,” where AI-generated identities and fraudulent transactions are used to infiltrate financial systems. Cybercriminals are leveraging advanced AI tools to forge documents, create realistic impersonations of executives, and execute high-value financial scams. These tactics not only cost institutions billions but also erode confidence in the authenticity of digital banking. In this high-stakes environment, financial institutions are being forced to invest heavily in AI-driven fraud detection systems and multilayered cybersecurity measures, but the arms race between attackers and defenders continues to escalate.

As the risk of cyberwarfare grows, high-net-worth individuals and corporations are turning to digital safe havens to secure their assets. These havens include blockchain-based decentralized financial networks, offshore banking options in jurisdictions with stringent cybersecurity laws, and even private vaults for cryptocurrency storage. Additionally, personal finance strategies are evolving to address the cyberwar era. Wealthy individuals are increasingly adopting cybersecurity insurance, diversifying assets across jurisdictions, and seeking expert guidance on protecting digital portfolios. For Wall Street clients, the key to navigating these risks lies in understanding how to safeguard investments against the specter of financial warfare and preparing for a future where cyber threats are not just a possibility but a certainty.

Black Swan Economics: The Next Financial War No One Sees Coming

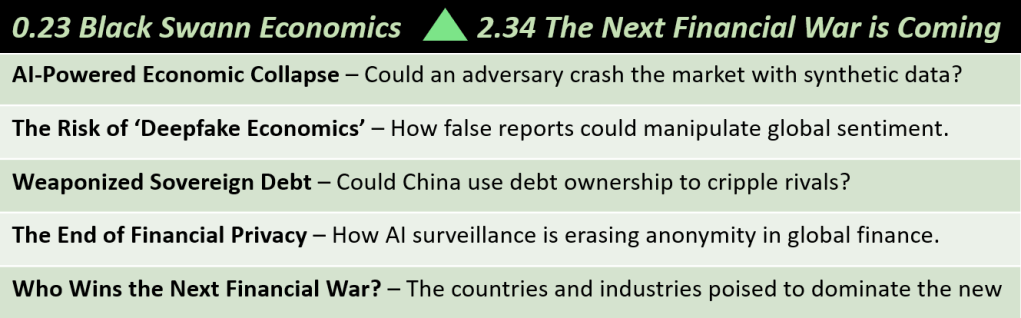

In an era of increasing reliance on data and artificial intelligence, the concept of AI-powered economic collapse is no longer far-fetched. Adversaries could generate synthetic economic data designed to manipulate stock markets, causing panic and triggering sell-offs. This tactic, known as “data poisoning,” could erode trust in the reliability of financial systems and create unprecedented instability. Governments and financial institutions are unprepared for such a scenario, as even advanced AI-driven algorithms might fail to differentiate between real and falsified market signals. The cascading effects of this could lead to liquidity crises, collapsing asset values, and global economic turmoil.

A related threat is the rise of “deepfake economics,” where falsified economic reports or statements from key policymakers are circulated to manipulate global sentiment. Imagine a fabricated video of a Federal Reserve Chair announcing an emergency interest rate hike or a false report of a country’s default. These deepfakes could incite massive financial shifts in real time before being debunked. The speed of today’s markets, coupled with the viral nature of social media, leaves little room for error. Investors and policymakers alike must develop rapid-response frameworks to counteract disinformation campaigns that could exploit this vulnerability.

Weaponized sovereign debt presents another chilling prospect for financial warfare. Nations like China, which hold substantial amounts of U.S. Treasury securities, could theoretically leverage this economic power to destabilize rival economies. A mass sell-off of sovereign bonds, for example, could drive interest rates higher, inflate borrowing costs, and create fiscal chaos. Similarly, AI-driven surveillance tools are eroding financial privacy, enabling states to monitor and manipulate capital flows more effectively. In this new era of financial warfare, the countries best positioned to dominate are those with advanced AI capabilities, robust financial infrastructures, and resilient regulatory frameworks. The next financial superpowers may not be determined by military strength or natural resources but by their ability to adapt to the uncharted terrain of economic disruption.

Blockchain and Digital Currencies

In recent years, various private-sector entities—including fintech startups, established financial institutions, and tech companies—have been leveraging blockchain technology to enhance cross-border payments. Blockchain offers increased security, transparency, and efficiency, reducing costs and processing times compared to traditional systems.

For instance, Ripple, a California-based fintech firm, operates RippleNet, a blockchain-based payments network. As of 2020, RippleNet connected hundreds of financial institutions across over 55 countries, facilitating faster and more cost-effective cross-border transactions. The network provides both financial messaging and clearing and settlement services, utilizing a decentralized platform that enables bidirectional messaging and enhanced transparency, allowing end-users to track payments in real-time.

Similarly, J.P. Morgan launched Liink (formerly the Interbank Information Network) in 2017, a real-time information-sharing system supported by blockchain technology. By 2020, Liink had onboarded more than 400 financial institutions, offering an alternative to traditional networks like SWIFT for cross-border payments.

The emergence of digital currencies also has the potential to reduce reliance on traditional financial messaging systems. Over the past decade, the private sector has developed numerous cryptocurrencies—digital assets that operate on distributed ledger technology without legal tender status. While currently representing a small and volatile market, some large corporations are working on more stable digital currencies for broader use. For example, in 2019, J.P. Morgan introduced JPM Coin, a digital token pegged to the U.S. dollar, designed for internal payments among institutional clients.

Central banks worldwide are also exploring the creation of their own digital currencies, known as central bank digital currencies (CBDCs). Unlike privately issued digital currencies, CBDCs would serve as legal tender and may not necessarily rely on blockchain technology. According to a 2021 survey by the Bank for International Settlements, 86% of central banks were actively researching or developing CBDCs. Depending on their design, CBDCs could further diminish the need for traditional financial messaging providers like SWIFT in facilitating transactions.

Overall, the integration of blockchain technology and the development of digital currencies are reshaping the landscape of cross-border payments, offering alternatives that may eventually reduce dependence on established financial messaging systems.

Key Questions Still Without Answers

What are the benefits and costs of U.S. reliance on a widely used financial messaging system headquartered in another country? Should the United States create its own financial messaging system and/or adopt a digital dollar that reduces the need for financial messaging services?

To what extent do new financial messaging systems, including by the governments of Russia and China, replicate the services provided by SWIFT? How does the entry of new financial messaging providers into the market impact U.S. consumers and businesses, as well as U.S. economic and foreign policy interests? What implications does the fragmentation of the cross-border payments system have for international economic stability?

How do new technological developments interface with legacy financial messaging systems? What are the broader implications for U.S. consumers and businesses, financial market stability, and broader U.S. interests?

To what extent, if at all, do China’s and Russia’s new financial messaging systems address money laundering and terrorism financing concerns?

Is the United States able to assess the cybersecurity of financial messaging service providers in other jurisdictions? If so, how can the U.S. government ensure the level of cybersecurity is sufficient to protect U.S. consumers and businesses?

Should the United States initiate increased multilateral cooperation on issues related to cross-border payments, such as promoting harmonizing financial messaging standards, increasing the efficiency of cross-border payments, or promoting resilience against cyberattacks?

Do sanctions against financial service providers like SWIFT advance U.S. national security and foreign policy goals, and if so, under what circumstances? What are the benefits and costs? Do the new financial messaging systems undercut the effectiveness of U.S. sanctions? What is the impact on the use of the U.S. dollar in the global economy?

Top Six Takeaways:

1. AI is becoming the most powerful tool in financial warfare — both for attack and defense.

2. Sanctions are evolving from blunt instruments to precise, AI-driven economic weapons.

3. China’s digital currency and alternative systems pose an existential challenge to U.S. dominance.

4. High-frequency trading and algorithmic manipulation could become the new form of state-sponsored cyberwarfare.

5. Cyberbanking attacks will target financial institutions, but also individual investors.

6. The biggest threats aren’t conventional wars—they’re the financial ‘Black Swans’ no one sees coming.

Conclusion: Are We Ready for the Next Financial War?

The battlefield of the 21st century is economic, and the weapons of choice are sanctions, AI, and financial manipulation. Wall Street, government regulators, and global investors must recognize the risks posed by financial warfare and prepare accordingly. The rise of AI-driven sanctions, high-frequency trading manipulation, and digital currency competition represents a seismic shift in how power is wielded.

The next great war may not be fought with missiles or tanks, but with algorithms and economic coercion. The question remains—who will emerge as the financial superpower of the future? The answer may determine the fate of global stability for decades to come.

Additional Information

Sources, Acknowledgements and Image Credits

{1} From Wall Street to the Pentagon | The Role of Finance in Modern Warfare. Image Credit: PWK International Advisers. 02 FEB 2025

{2} How the Money Gets Moved. Source: PWK International Advisers. 02 FEB 2025

{3} Blockchain and Digital Currencies. Image Credit: PWK International Advisers. 02 FEB 2025

{4} Key Questions Still Without Answers. Credit: Congressional Research Service. Background and Issues for Congress. Liana Wong. Analyst in International Trade and Finance. Rebecca M. Nelson. Specialist in International Trade and Finance.

{5} Top Six Take-Aways. Source and Image Credit: PWK International Advisers. 02 FEB 2025

About PWK International Advisers

PWK International provides national security consulting and advisory services to clients including Hedge Funds, Financial Analysts, Investment Bankers, Entrepreneurs, Law Firms, Non-profits, Private Corporations, Technology Startups, Foreign Governments, Embassies & Defense Attaché’s, Humanitarian Aid organizations and more.

Services include telephone consultations, analytics & requirements, technology architectures, acquisition strategies, best practice blue prints and roadmaps, expert witness support, and more.

From cognitive partnerships, cyber security, data visualization and mission systems engineering, we bring insights from our direct experience with the U.S. Government and recommend bold plans that take calculated risks to deliver winning strategies in the national security and intelligence sector. PWK International – Your Mission, Assured.