UAP and the Defense Industry: Risks, Markets, and Contracting Opportunities. This report offers an assessment of how the UAP phenomena has shifted from a public spectacle to an engineering and acquisition problem set. This report unpacks the practical implications for defense suppliers, program managers, and capture teams: where risks are exposed for prime contractors, where business opportunities are opening for dual-use innovators and disruptors, and how business development and product strategies should evolve to deliver warfighter decision advantage where the increasing presence of unexplained phenomena are now a big part of battlefield sense making.

UAP stopped being a cultural headline and became an acquisition problem the moment governments decided the right answer to ambiguity was better data, not better speculation. For the defense industry that translates into a predictable set of demands: metadata, sensor fusion, data provenance, and an evidence pipeline robust enough to survive congressional scrutiny and operational stress. Its time to treat UAP as an engineering and capability integration problem . . . and opportunity.

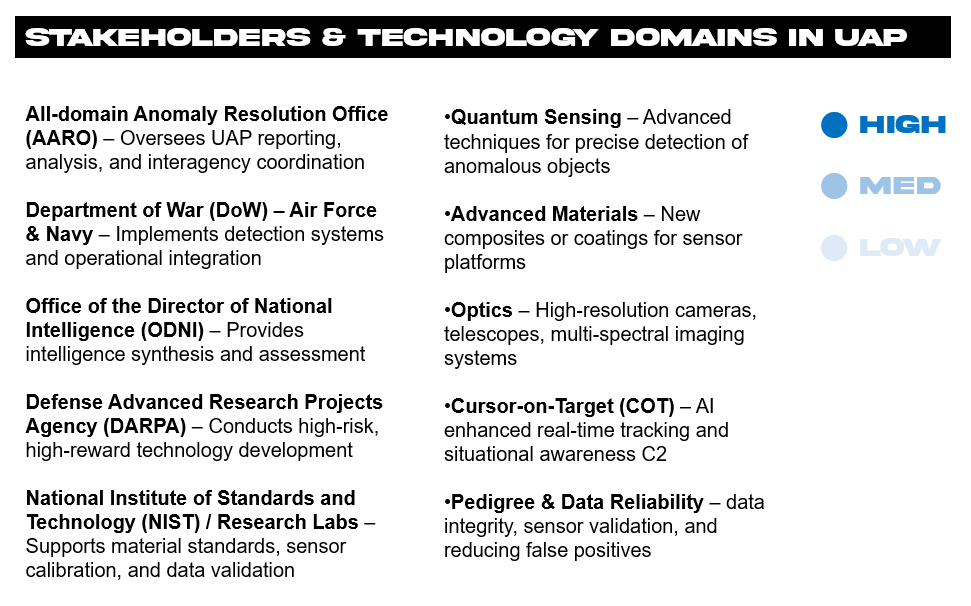

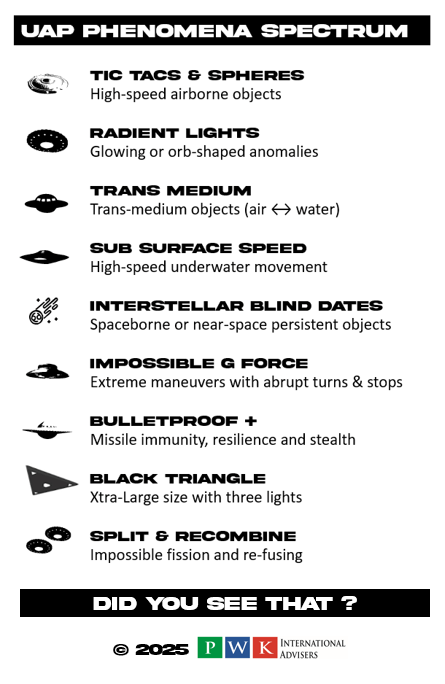

The headline from government reporting is blunt: hundreds of incidents, dozens of cases that remain unresolved due to insufficient sensor data, and no validated evidence of off-world technology. What matters to industry isn’t the absence or presence of aliens — it is the revealed failure modes in sensing, data fusion, and real-time adjudication that drive new demands for hardware, software, services, and integration. The All-Domain Anomaly Resolution Office (AARO), ODNI, and the Pentagon have moved from patchwork reporting to centralized analysis and explicit S&T planning — a shift that creates a set of real, fundable requirements the defense market will be asked to meet. Director of National Intelligence+1

In this report, we map the defense-industry procurement noise, program risk, reputational exposure, near-term markets, (sensor suites, data fusion, forensic analytics, secure cloud edge inferencing), and strategy moves that primes and small business innovators and disruptors should make to align capability with this rapidly maturing government problem set and major risk to national security mission(s) and public air safety.

UAP | An Uncertainty Tax on Defense Programs

Ambiguity is an economic stressor. When detection is inconclusive, decision timelines stretch, program offices expend labor and money on triage, and acquisitions become conservative or conversely, panicked. Across 2023–2024 the government recorded hundreds of reports and acknowledged a material share could not be resolved because of insufficient, low-quality, or non-correlated sensor data — a condition that directly maps into procurement requirements for higher-fidelity sensing and improved multi-INT fusion with battlefield data governance and multi-domain orchestration through modernization programs like combined joint all domain command and control (CJADC2), Project Overmatch, Maven, Lattice and others.

AARO/DoW consolidated reporting lists large volumes of incidents and emphasizes insufficient sensor quality as the core problem.

This condition produces three cascading effects:

- Demand volatility. Program offices shift money quickly toward “risk reduction” buys (sensors, analytics) when political or flight-safety pressure rises, then re-allocate once immediate oversight pressure declines. That creates boom-and-bust pathways in small and mid-tier suppliers unless contracts are structured as IDIQs or follow-on services.

- Integration premium. The value migrates to systems integrators who can stitch together radar, EO/IR, RF, space-based sensors, and cloud analytics into an adjudication pipeline. Pure sensors without fusion rarely close deals at scale.

- Information arbitrage. Vendors who can show provenance, chain-of-custody, and metadata-rich ingestion win faster. The government’s need is not raw video; it is defensible, timestamped, cross-referenced evidence.

These forces convert a public curiosity into a procurement vector: treat UAP as a symptom that highlights where the defense buyer will spend on reducing uncertainty.

The politics of the unexplained: Senators leading the charge for UAP transparency are reshaping how Congress thinks about intelligence gaps, sensor data, defense program funding priorities and appropriation budget increases.

Risks to Industry — What Can Go Wrong (and Fast)

A. Program and Capture Risk (Mis-framed offers)

When a program office scrambles to respond to new campaign plans or committee oversight, it can procure fast and clumsily. Vendors that pitch point solutions (e.g., “we have a UAP camera”) without integration promises or data provenance assurances will lose to incumbents that can demonstrate end-to-end adjudication and sustainment. Procurement teams penalize single-sensor proposals when Congress and AARO demand cross-INT validation.

B. Reputational Risk (adjacent to sensationalism)

Association with “UFO” narratives can be toxic to prime brand teams seeking serious defense dollars. Firms must avoid hyperbolic marketing language. The successful vendors reframe product offers into “anomaly reduction,” “sensor resiliency,” or “forensic ISR” rather than UAP-centric branding. Recent official reporting underscores the technical, not mystical, nature of the work — that framing must be mirrored by vendors. Reuters

In May 2022, the House Intelligence Committee held a public hearing on unidentified aerial phenomena (UAPs), also known as UFOs, for the first time in over 50 years. The hearing was the culmination of years of growing interest in UAPs due to flight safety and other impacts, both from the public and from the government.

C. Technical Risk (failure to deliver usable data)

Contracts will increasingly specify metadata, synchronized timestamps, geolocation accuracy, and secure ingestion. Systems that cannot meet these minimal data hygiene requirements will be contractually useless. AARO’s S&T planning explicitly calls out the lack of high-quality sensor data as a major barrier to resolution — vendors who cannot show rigorous sensor characterization and QA will be filtered out early.

Implications for vendors: guard your messaging, build integration proofs, and invest in metadata/forensics capabilities before chasing opportunistic buys.

Near-Term Opportunities

1. Sensor Suites Built for Forensics and Fusion

Not just better cameras or radars — sensor packages that generate actionable metadata, synchronized across modalities, and designed for post-event forensic analysis. AARO and DoD calls for higher quality data mean agencies will fund testbeds and early fielding of these suites. Vendors that can demonstrate controlled experiments, calibration processes, and multi-sensor fusion pipelines will be preferred.

2. Edge-to-Cloud Ingestion + Provenance Layers

The government needs chain-of-custody: authenticated sensor feeds, tamper-evident logs, synchronized timestamps, and secure, compliant cloud ingestion. Companies that provide hardened edge devices with cryptographic provenance plus compliant ingestion into government clouds (or approved C2/ISR backplanes) will have an advantage.

3. Anomaly Adjudication Software & AI

Where Project Maven and similar AI efforts have already shown demand for ML pipelines that sift high volumes of ISR into decision sets, UAP creates another use case: triage and confidence scoring for anomalous events. Contracts expanding Maven-style AI work (recent Palantir/DoD moves and renewed interest in AI-based analytics) signal growing budgets for analytic layers that convert sensor clutter into ranked hypotheses. DefenseScoop

4. Testbeds, Instrumentation, and S&T Partnerships

AARO’s public S&T planning and statements about deploying new sensor suites suggest funding for instrument testbeds, university partnerships, and foreign interoperability experiments. Small companies can trade technical IP and experimental platforms for access to government test ranges and follow-on contracts.

5. Services: Triage, Forensics, and Policy Support

Consulting and analytic services that help program offices design reporting pipelines, build data standards, and establish adjudication playbooks will be in demand. This is a services-heavy problem: training, SOP drafting, red-team data exercises, and results presentation to oversight committees.

Business

Development Playbook

How Innovators

Can Organize

for Success

Commercial strategy: position products as “uncertainty reduction” tools, demonstrate integration, and get to pilots/testbeds fast. Contracts increasingly favor OTA’s, IDIQs and modular open architectures — be ready. If UAP is a procurement forcing function, then the BD playbook must change accordingly. Here are tactical moves for primes, mid-tiers, and startups.

For Primes

- Bundle metadata guarantees into RFP responses. Show how you will deliver calibrated, documented sensor outputs, not just raw video/images.

- Lead with systems integration case studies that show multi-INT adjudication in contested environments.

- Offer modular sustainment — anomaly programs will need long tails of analysis support.

For Mid-Tier Systems Integrators

- Specialize in provenance and ingestion. Bridge legacy sensors into modern pipelines.

- Co-bid with small, specialized sensor firms for low-cost rapid prototyping.

- Own the testbed relationship (range time, instrument placement, data collection plans).

For Startups

- Package your offering as a testable module that answers a narrow government use case (e.g., time-synchronized EO+IR+RF ingestion).

- Prioritize export-control counseling — many sensor platforms run into ITAR/Export issues that slow contracts.

- Win pilots by agreeing to rigorous evaluation metrics (e.g., classification accuracy at certain SNRs, time to adjudication).

Geopolitical

Considerations

Why This Isn’t

Only a Domestic Market

Treat UAP as a symptom of a global sensing environment. Adversaries already exploit sensor limits: balloon-borne sensors, masked radar signatures, decoys, and low-signature UAS are tools for gray-zone competition. The same products built to resolve UAP cases (resilient fusion, provenance layers, hardening against spoofing) have export appeal to allied air-domain awareness programs and NATO partners seeking common standards. AARO is already exploring international engagement for sensor sharing and case correlation — a signal that interoperable systems will be valued. Breaking Defense+1

Export opportunity: firms that adopt export-friendly baselines (non-ITAR options, coalition-ready APIs) can capture allied buys and multinational testbeds — but must balance this against U.S. security requirements.

Policy & Ethics — A Non-Technical Constraint That Shapes Markets

Procurement here is not only technical — it’s political. Agencies will require:

- clear privacy and civil-liberties guards for persistent sensing

- protocols to avoid mission creep

- auditability to satisfy congressional oversight.

Vendors must bake these features into architecture and marketing. A system that is technocratically brilliant but politically naive will be blocked by compliance and oversight, especially given the political salience of UAP hearings in recent Congresses. Oversight Committee

Scenarios — Tactical Plays for 12–36 Months

Below are concrete scenarios companies should pitch to procurement leads, with expected value propositions.

- Rapid Adjudication Pilot (6–9 months). Deliver a deployed multi-sensor node, ingest into a secure cloud, and produce adjudication reports within 72 hours for a deployment range. Value = immediate demonstration + political risk reduction.

- Metadata Hardened Edge Camera (9–12 months). A low-cost device with crypto-signed timestamps and inertial measurement metadata that supports single-station forensic analysis. Value = meets minimum data quality thresholds.

- Anomaly Triage SaaS (12–18 months). Integration with enterprise C2 and Maven-style analytics to provide ranking of anomalies and confidence intervals for program offices. Value = reduces analyst time and provides defensible outputs for oversight.

- Coalition Interop Testbed (18–36 months). Partner with allied test ranges to validate sensors under multiple environmental conditions and publish joint standards. Value = export pipeline + long-term sustainment contracts.

Each scenario focuses on time-boxed delivery, measurable performance, and narrative value for congressional oversight committees.

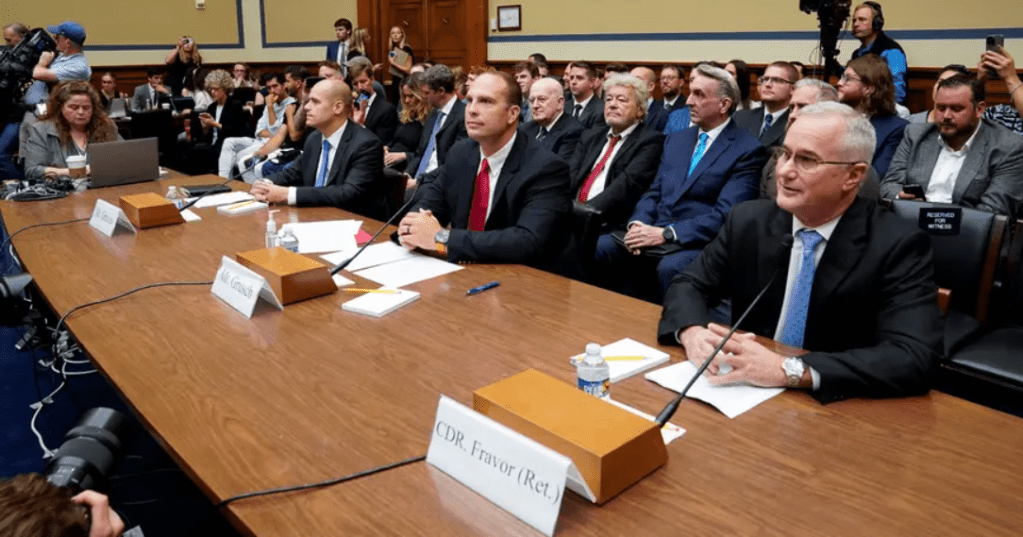

CAPTION: Ryan Graves, executive director of Americans for Safe Aerospace, David Grusch, former National Reconnaissance Office representative on the Defense Department's Unidentified Aerial Phenomena Task Force, and retired Navy Commander David Fravor are sworn in during House Oversight & Accountability Committee's National Security, the Border, and Foreign Affairs Subcommittee's hearing on "Unidentified Anomalous Phenomena: Implications on National Security, Public Safety, and Government Transparency" at the U.S. Capitol Hill in Washington, USA. REUTERS/Elizabeth Frantz

Incumbents, Past Performance, Teaming Arrangements and Best Practice Partners (partial list)

The evolving landscape of unidentified aerial phenomena research and defense technology has given rise to a quiet but significant ecosystem of private contractors, research institutions, and aerospace innovators. Success in this space increasingly depends on teaming arrangements—strategic alliances that combine sensing expertise, classified infrastructure, and rapid prototyping capabilities. These partnerships bridge legacy defense primes with agile innovators and specialized labs, ensuring data credibility, engineering rigor, and operational readiness. The emerging “post-UAP” industrial base is defined not just by what it observes, but how it collaborates—linking telemetry pipelines, materials science, and advanced AI analytics into a coherent enterprise for understanding anomalies across air, space, and maritime domains.

L3Harris Technologies — Melbourne, FL — L3Harris is a leading provider of electro-optical/infrared (EO/IR) imaging systems, maritime-optimized sensors, and integrated counter-UAS solutions tailored for air-and-sea anomaly detection. L3Harris® Fast. Forward.+1

General Atomics Aeronautical Systems (GA-ASI) — San Diego, CA — GA-ASI produces long-endurance remotely piloted aircraft (e.g., MQ-9/SeaGuardian) and modular sensor packages (SAR, EO/IR, ASW payloads) that enable extended maritime and littoral surveillance for submerged and trans-medium anomaly observation. General Atomics+1

Anduril Industries — Costa Mesa, CA — Anduril integrates autonomous systems, the Lattice command-and-control fabric, and maritime/air sensor stacks (counter-UAS and persistent coastal surveillance) to provide near-real-time fusion and edge analytics. Anduril Industries+1

Palantir Technologies — Denver, CO — Palantir supplies enterprise-grade data-fusion and analytic platforms that emphasize provenance, access control, and auditability for ingesting, cross-referencing, and producing defensible intelligence products from heterogeneous sensor feeds. Palantir+1

Leidos — Reston, VA — Leidos develops integrated sensor systems (radar, EW, ground sensing) and mission software for real-time tracking, cross-domain correlation, and operational analytics supporting government ISR customers. Leidos+1

Bigelow Aerospace — North Las Vegas, NV (historical / programmatic relevance) — Bigelow Aerospace (Robert Bigelow’s company) built expandable space-habitat modules and has been a noted private-sector stakeholder in space R&D and fringe-research funding—useful to document as a nontraditional actor with interest in anomalous phenomenon research and space habitat tech. Wikipedia+1

EG&G / (now part of URS/AECOM historic lineage) (HQs: Woburn, MA / Gaithersburg, MD) — EG&G’s legacy work in test ranges, instrumentation, and government technical services (many capabilities later rolled into URS/AECOM) is relevant historical context for contractor experience in classified test-range sensor operations and forensic instrumentation. Wikipedia+1

NOTICE: Our unbiased report includes mention of numerous defense and aerospace innovators and disruptors. All registered trade marks and trade names are the property of the respective owners.

Conclusion — UAP Is a Demand Signal, Not a Storyline

UAP stopped being a cultural headline and became an acquisition problem the moment governments decided the right answer to ambiguity was better data, not better speculation. Our research shows that based on how military and civil aviation pilot whistleblowers have been treated, this is less a matter of extra-terrestrial intelligence and more a matter of terrestrial stupidity.

If industry adopts the right posture — rigorous data standards, integration proof over hype, and political awareness — the UAP episode becomes a durable market: an era of funding and testbeds for systems that reduce uncertainty across air, land, sea, space, and cyberspace, and help secure the increasingly fatal civil aviation industry.

UAP is not a only an evolving threat class; it is a new procurement demand signal in a fast moving world filled with unexplained phenomena that confuses battlefield sense making and poses serious risks to both national security and commercial air safety.

ADDITIONAL INFORMATION

COLORS

OF

MONEY

HOW

THE US FUNDS

INNOVATION

DETERRENCE AND

POWER PROJECTION

Sources, Acknowledgements and Image Credits

{1} UAP | Unidentified Anomaly or Demand Signal is an Expert Network Report written by PWK International Managing Director David E. Tashji November 11, 2025. David is a Pentagon acquisition college trained expert on the Business of Government and a pre-milestone A specialist with deep experience in MDD entry artifact production (ICD, AoA, ASP,) and Federal acquisition strategies for Airborne Radar Aircraft (E3 Sentry) Strike Aircraft (F-15 FA-18), Satellite Constellation Global Aircrew Strategic Network Terminal (Global ASNT) (MEECN), Unmanned Air Vehicles (RQ-4 Global Hawk), and Nuclear Warfighter Secure Communications Secure Anti-Jam Reliable Tactical Terminal (SMART-T). Image Credit: (C) PWK International. All Rights Reserved.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means—electronic, mechanical, photocopying, recording, scanning, or otherwise—without the prior written permission of the author, except in the case of brief quotations embodied in critical articles, reviews, or academic work, or as otherwise permitted by applicable copyright law.

“UAP Demand Signal” and all associated content, including but not limited to the report title, cover design, internal design, maps, engineering drawings, infographics and chapter structure are the intellectual property of the author. Unauthorized use, adaptation, translation, or distribution of this work, in whole or in part, is strictly prohibited.

This report is a work of non-fiction based on publicly available information, expert interviews, and independent analysis. While every effort has been made to provide accurate and up-to-date information, the author makes no warranties, express or implied, regarding completeness or fitness for a particular purpose. The views expressed are those of the author and do not necessarily represent the views of any employer, client, or affiliated organization.

All company names, product names, and trademarks mentioned in this report are the property of their respective owners and are used for identification purposes only. No endorsement by, or affiliation with, any third party is implied.

{2} Contracting trend coverage (Project Maven / Palantir and broader AI analytics push reflecting increased investment in analytic pipelines). DefenseScoop

{3} AARO / Department of Defense consolidated reporting and AARO homepage (AARO emphasizes the need for better sensor data and has published both historical and annual reports). AARO+1

{4} ODNI Consolidated Annual Report on UAP (unclassified summary and submittal to Congress). Director of National Intelligence

{5} Reporting on AARO’s S&T plan and initial sensor-suite deployments (journalism and defense trade press coverage of AARO’s planned sensor investments and testbeds). Breaking Defense

{6} Reuters / AP coverage of DoD annual UAP findings (most cases ordinary or unresolved due to insufficient data). Reuters+1

{7} ARPA — Robust Quantum Sensors (RoQS) program

DARPA’s RoQS program aims to make quantum sensors robust enough for real-world military platforms, a direct enabler for detecting anomalous objects with high sensitivity. RoQS focuses on advancing quantum sensing hardware and algorithms so sensors resist vibration, EMI, and other field effects that today limit deployment outside the laboratory. DARPA

{8} DARPA — QuSeN (Quantum Sensing of Neutrinos) program

QuSeN develops ultra-sensitive detectors for faint signals (neutrinos) — an example of DARPA’s investment in exotic sensing approaches applicable to detecting subtle, otherwise-invisible phenomena.

While focused on neutrino detection, QuSeN demonstrates DARPA’s push toward fundamentally new sensor modalities and large-scale signal extraction that could be repurposed for anomaly detection. DARPA

{9} DARPA feature: quantum sensing & computing overview

A DARPA overview page explaining how quantum sensing and related investments fit into DoD capability goals such as GPS-denied navigation and high-sensitivity detection. This public DARPA summary places quantum sensing investments in the broader context of fieldable PNT, detection in denied environments, and transformational sensing modalities. DARPA

{10} Defense Innovation Unit (DIU) — “Advancing quantum sensing for the DoD”

DIU coverage of rapid field testing and transitioning of quantum sensing prototypes from lab to operational environments (including orbit tests). DIU’s announcements document near-term efforts to move prototype quantum sensors into field tests for magnetic and gravity-aided navigation and anomaly detection. Defense Intelligence University

{11} NASA — UAP study team (NASA Science Office)

NASA’s official UAP study page describing the agency’s scientific review of available UAP data and recommendations for future data collection. NASA’s UAP study emphasizes standardizing data collection, metadata capture, and open scientific evaluation as prerequisites for robust UAP analysis. NASA Science

{12} Breaking Defense — coverage of AARO sensor deployments & GREMLIN suite

Reporting on AARO’s planned sensor testbeds (GREMLIN) and the office’s acknowledgement of data-quality shortfalls. Investigative reporting describes AARO’s first field sensor suites and testbeds and quotes AARO officials who stress the need for multi-sensor data to close evidence gaps. Breaking Defense+1

{13} DefenseScoop — AI analytics / Project Maven / broader analytic pipeline trend coverage

Industry reporting on the DoD’s broader push for AI analytics, including precedents like Project Maven that set expectations for analytic pipelines. These pieces track how large analytics investments and contractor ecosystems (e.g., big-data ingestion, video analytics) create capability baselines that UAP evidence platforms must meet. DefenseScoop

{14} DoD / War Department public statement on UAP and AARO mission

Official DoD public page describing AARO’s mission, reporting patterns, and coordination role across DoD sensor assets. The DoD emphasizes AARO’s role in consolidating UAP reporting, improving data quality, and coordinating sensor tasking across services. U.S. Department of War

{15} Office of the Director of National Intelligence (ODNI) — Preliminary Assessment (PDF)

ODNI’s declassified preliminary intelligence assessment on UAP that outlines what is known, unknown, and the limits imposed by poor data quality. The ODNI assessment documents that most cases remain unexplained primarily because of insufficient, inconsistent, or low-fidelity sensor data, underlining the need for provenance and metadata. ODNI+1

{16} U.S. Congressional hearing materials — “Unidentified Anomalous Phenomena” (House Oversight / Joint Hearing) Official hearing page, transcript, and committee PDF that cover legislative oversight and witness testimony on UAP program activity and transparency. Congressional hearings in 2023–2024 produced public testimony and transcripts that highlight programmatic shortfalls (data gaps, interagency coordination) and signal potential congressional priorities for verifiable evidence chains. Congress.gov+2Congress.gov+2

{17} NGA (FOIA log / records indicating internal references to UAP terms)

NGA FOIA-released logs showing internal records and search terms related to UAP/UFO queries — useful to document geospatial/intelligence interest. NGA documents obtained via FOIA indicate the agency fields internal requests mentioning UAP/UFO terminology, reinforcing that geospatial intelligence organizations are stakeholders in sensor and provenance requirements. National Geospatial-Intelligence Agency

{18} NIST — NIST IR 8387 and SP 800-86 (forensic guidance and evidence management)

NIST publications that set guidance for digital evidence handling, chain-of-custody, and forensic readiness—directly applicable to metadata and provenance standards for UAP evidence. NIST’s IR 8387 and SP 800-86 lay out practices for preserving and documenting digital and sensor evidence, recommending hashing, logs, and documented transfer records that preserve admissibility and trust. NIST Publications+1

{19} DHS / CISA and DHS S&T guides on chain of custody and digital video quality

DHS Science & Technology and CISA publications on chain-of-custody, digital video quality standards, and evidence management best practices. DHS/CISA technical notes and video-quality handbooks provide operational checklists for ensuring video authenticity, tamper detection, and RFID/evidence-tracking for physical artifacts. Department of Homeland Security+2CISA+2

{20} Digital forensics & academic literature on chain of custody and evidence integrity (peer-reviewed sources) Academic reviews and medical/forensic papers that reiterate principles of chain-of-custody, unique identifiers, and documentation standards—applicable to UAP sensor pipelines. Peer-reviewed analyses explain chain-of-custody requirements and propose metadata schemas and audit trails that preserve evidentiary value in high-stakes investigations. PMC+1

About PWK International

PWK International is a strategic research and advisory firm focused on the intersection of advanced technology, geopolitics, and the business of government. Through original analysis, structured intelligence products, and deep experience inside the federal ecosystem, PWK International helps organizations understand how power, bureaucracy, procurement, and innovation converge. The firm’s work spans AI, autonomy, defense acquisition, emerging threats, and the evolving landscape of great-power competition.

Founded on the belief that understanding first is a competitive advantage, PWK International translates complex government programs into actionable insight for industry leaders. From early-stage innovators to established defense contractors, clients rely on PWK’s assessments to navigate federal demand signals, anticipate shifts in policy, and position themselves for strategic growth. With a research portfolio covering technologies from UAP sensing to autonomous navigation, PWK International provides frameworks that illuminate where opportunities exist—and how to pursue them.